UNLOCKING THE POWER OF cTRADER: A COMPREHENSIVE GUIDE FOR TRADERS

cTrader is a forex trading platform made by the London-based company cTrader Limited. The platform is different since the London company created it for usage with ECN brokers. Since its initial launch with FxPro, cTrader has been the platform of choice for several other top ECN brokers, including Liquid Markets, Pepperstone, and Admiral Markets.

EMBARKING ON YOUR cTRADER JOURNEY

IEmbarking on your cTrader journey is exciting and rewarding if you follow the procedures I will highlight below. The power of cTrader lies in its versatile trading platform. To embark on your cTrader journey, choose the right broker first. Not all brokers offer this platform. TP Market Trades is one of the best brokers through which you can access this platform. Visit the TP Market Trades’ website and study their fees, trading conditions, and customer support before you join them.

CRAFTING YOUR cTRADER ACCOUNT

Let us look at the steps you can take to craft your cTrader account properly.

OPEN A TRADING ACCOUNT ON cTRADER.

A primary factor contributing to network latency is the physical separation between the device making data requests and the server responsible for responding. For instance, if your company is situated in London, engaging in trading activities with markets in Beijing can become problematic when latency is substantial.

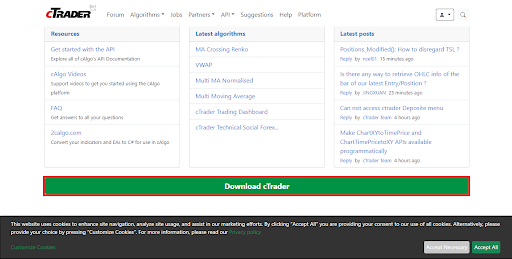

Once you have chosen TP Market Trades as your preferred broker, you must open a trading account on the cTrader account. Opening the account is straightforward. Visit the cTrader website through your browser. Click the download button on their website at the bottom of the open window.

cTrader Download Button

You get numerous options from which to choose. You can click on either of the options, after which you must log in to open an account successfully.

cTrader Deposit Options

FUND YOUR TRADING ACCOUNT

The next step to crafting your account is funding it. The platform offers multiple options for depositing funds into your account, including credit cards, debit cards, and bank wire transfers.

SET UP YOUR TRADING PREFERENCES

Establishing your trading preferences within the cTrader platform is a crucial milestone in achieving success as a trader. You should customize the trading platform to your needs. Customizing the platform will ensure you have the proper tools and resources to trade. To set up your trading preferences on cTrader, follow these steps:

Open the cTrader platform and log in to your account.

Click the Settings button in the lower-left corner of the platform to open the settings window.

cTrader Setting Button

In the settings window, you can customize a variety of settings, including:

- Order type settings: Set the default order type and execution mode for each order type.

- QuickTrade settings: Set the default settings for the QuickTrade feature.

- Chart trading settings: Set the default settings for placing orders from charts.

- Slippage settings: Set the maximum slippage allowed for each order type.

- Trailing stop settings: Set the default settings for trailing stop orders.

cTrader Settings Window

After customizing the platform, click OK to complete the customization process.

PRACTICE TRADING ON THE DEMO ACCOUNT

The platform has a demo account. This type of account offers you real market experience without any risk involved. It is a good way to sharpen your trading skills before trading with real cash through the TP Market Trades broker.

SEAMLESSLY NAVIGATING cTRADER’S INTERFACE

Visually, cTrader’s interface is incredibly clean and appealing; it has an uncomplicated and user-friendly layout. The designers went to considerable lengths to ensure the entire platform was simple. The platform has several main sections:

Menu bar: The menu bar is found at the top of the platform and contains all of the main functions of cTrader. These include order execution and timeframes.

cTrader Menu Bar

Toolbar: The toolbar is below the menu bar on the right side of the trade window and contains shortcuts to the most commonly used functions of cTrader.

cTrader Toolbar

Market Watch window: The Market Watch window displays a list of available trading instruments. You activate it by clicking the menu button in the top left corner.

cTrader Market Watch window

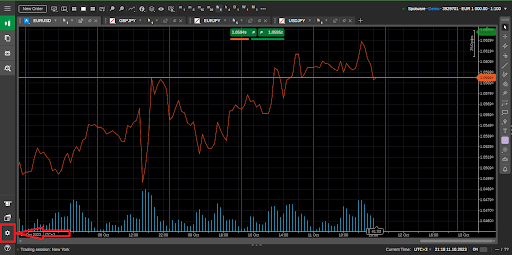

Chart window: The chart window displays a price chart for the selected trading instrument.

Trade window: The trade window allows traders to place and manage orders.

ANALYZING MARKETS WITH PRECISION

The cTrader platform facilitates the analysis of markets with precision. Here are some of the platform’s features you can use to analyze markets.

- You can use cTrader’s charting tools to identify trends and support and resistance levels. cTrader has many charting tools, such as technical indicators, drawing tools, and multiple chart types.

- You can improve your understanding of market sentiment and momentum using the platform's technical indicators. Moving averages, oscillators, and trend indicators are among the technical indicators available in cTrader.

- You can evaluate markets from many angles using the platform's multiple timeframes. You can browse many timeframes simultaneously in cTrader. This tool allows you to spot long-term trends and short-term trade possibilities.

- Use the platform's backtesting and optimization capabilities to test and develop your trading methods. You can put your trading techniques to the test using backtesting and optimization tools. Backtesting allows you to select the most profitable strategies.

MASTERING ORDER TYPES AND EXECUTION

cTrader provides various order types and execution techniques, allowing you to customize trading to your needs and tastes.

Here are some of the most common order types on cTrader:

- Order of the market: A market order is a purchase or sale of an asset at the best available price.

- Limit order: A limit order is purchasing or selling an asset at a specific price or better.

- A stop order is an order to purchase or sell an asset when the market price reaches a certain level.

- A trailing stop order is an order to purchase or sell an asset if the market price moves a particular amount in a favorable direction.

cTrader also provides many execution settings, allowing you to select how TP Market Trades executes your orders.

- Instant execution: The default execution mode on cTrader is instant execution. Dominion Market immediately executes your order at the best available price.

- Market execution is comparable to instant execution, except it allows for a tiny degree of slippage. Slippage occurs when the asset's price changes between when you place your order and when TP Market Trades executes.

- Request execution allows you to designate the lowest price you will acquire or sell an item. TP Market Trades will only execute your order if the asset's price meets your specified price.

SAFEGUARDING YOUR INVESTMENT: RISK MANAGEMENT

Risk management is key when trading. Managing your account risk can be the difference between having a successful trading career or not. Here is how you can manage risk on cTrader.

You can use stop-loss orders to limit trading losses. With a stop-loss order, you exit a trade when the price reaches the set stop-loss level.

Use take-profit orders to lock in profits. Take-profit orders allow you to exit a trade when the market price reaches a set level. Taking profits allows you to lock in profits and protect your capital.

AUTOMATION EMPOWERMENT: cTRADER’S TOOLS

cTrader provides several automation features for automating trading techniques. Among these tools are:

cTrader Automate: cTrader Automate is an algorithmic trading platform embedded into cTrader that allows you to design and automate trading strategies. cTrader Automate uses the C# programming language. C# is a popular programming language programmers use to create software applications.

The cTrader API is a collection of programming interfaces that enable developers to design custom trading apps. You can use the cTrader API to automate trading methods and construct other trading-related products.

cTrader Copy: cTrader Copy is a social trading platform allowing traders to replicate successful deals. cTrader Copy allows you to automate trading by copying trades from successful traders.

TRADING UNLEASHED: cTRADER MOBILE APP

In the first quarter of 2021, cTrader announced a new version of its mobile app, cTrader Mobile 4.1. Since the beginning of the decade, demand for mobile trading has risen, fueled by an influx of new millennial traders. As a result, cTrader is constantly improving its market-leading out-of-the-box trading solution. Here are the characteristics of Mobile 4.1.

Trading: The cTrader mobile app allows you to trade various financial assets, including Forex, CFDs, ETFs, and stocks. You can place market orders, limit orders, stop orders on the fly, and manage your positions and orders.

Charting: The cTrader mobile app includes many charting tools and technical indicators that help you monitor markets and spot trading opportunities. You can also create and save custom charts.

EXPLORING ADVANCED TRADING TECHNIQUES

cTraders provides traders with advanced trading tactics. Algorithmic trading, for example, employs computers to automate sophisticated trading methods that are difficult to execute manually.

High-frequency trading is another advanced trading approach. It is algorithmic trading in which high-powered computers make fast deals. You can use this strategy to profit from modest price swings in small markets.

PROVEN TIPS AND STRATEGIES FOR TRADING EXCELLENCE

Here are some of the proven tips and strategies for trading excellence.

- Make a trading strategy. Making trading strategies include a description of your trading objectives, risk tolerance, and trading tactics. Sticking to your trading strategy and not varying from it is critical.

- Make use of technical analysis. The study of past price charts and trends to discover trading opportunities is known as technical analysis. There are numerous technical indicators and instruments available for technical analysis.

- Utilize risk management. Risk management is critical for all traders. It entails placing stop-loss and take-profit orders to limit losses and safeguard profits.

TACKLING CHALLENGES: TROUBLESHOOTING GUIDE

If you're having difficulties with cTrader, you can try a few things to solve the problem.

1. Examine your internet connection.

Poor internet connectivity stands out as a common cause of cTrader problems. Ensure you have a good internet connection and your internet speed is adequate to support cTrader.

2. Relaunch cTrader

Restarting cTrader will typically resolve minor platform issues. Simply close and reopen the application to restart cTrader.

3. Empty the cTrader cache.

The cTrader cache can occasionally get corrupted, causing platform issues. Go to Tools > delete Cache to delete the cTrader cache

ELEVATE YOUR TRADING WITH cTRADER: CONCLUSION

Elevate your trading today with cTrader through the TP Market Trades, the best forex trading company. The platform is user-friendly, plus you can start your trading career properly