As a trader, you can work with any platform that is available. However, this article will focus on MT4 and cTrader. It will compare these two platforms and show why cTrader is the best option for most traders. Moreover, you will see all the superior features of cTrader before using the platform with TP Market Trades.

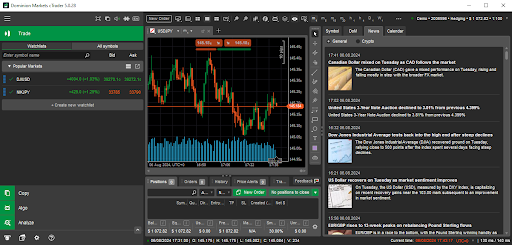

Spotware developed the cTrader platform in 2011. It is a modern-looking, simple-to-use platform that allows traders to customise most things. The platform comes with many features that make trading easier, including several chart types, trading tools, and order types.

cTrader platform

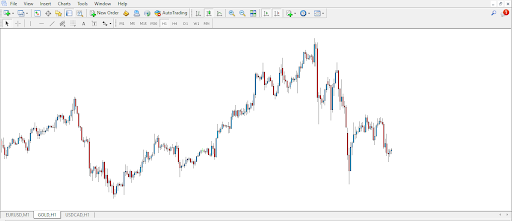

Meanwhile, the MT4 platform is an older version of MT5. It was created by MetaQuotes in 2005. The platform has an old-school look and basic trading features. MT4 also has a vast library of trading robots.

MT4 platform

A comparison of these platforms will show their similarities and differences. Therefore, in the end, you will understand why cTrader is a better platform than MT4.

The MT4 and cTrader platforms offer charts and charting tools for traders interacting with various markets. These include different chart types, timeframes, and indicators. However, the difference is in the numbers.

cTrader chart types

On the other hand, cTrader offers three more chart types in addition to the ones on MT4. These include Heikin Ashi, HLC and Dot. Moreover, traders can use 54 different timeframes to analyse prices, with 70 built-in technical indicators. This gives them the power to analyse prices better before deciding to trade.

MT4 chart types

MT4 offers three chart types: candlestick, bar and line. You can also access nine timeframes for analysing prices and 30 built-in technical indicators.

With MT4 and cTrader, you can view several charts at a time and create personal templates for later use. However, cTrader has a unique feature that allows you to detach single charts from the rest of the platform for a more focused view. Additionally, with cTrader, you can create multiple watch lists to follow your preferred asset prices.

Both MT4 and cTrader have neat and simple designs. However, while MT4 is outdated and rigid, cTraders has a more modern look and is flexible. With MT4, you can’t change much in the design, which means you get the same look for most of your trading journey.

On the other hand, cTrdaer allows you to customise many things in the design to suit your preferences. Therefore, it is more user-friendly.

cTrader list of assets

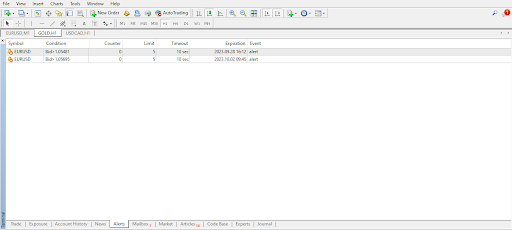

Both trading platforms include tools that make trading easier, such as news features, alerts, and signals.

Meanwhile, the cTrader platform comes with more advanced tools. For instance, there are more alert types for pending orders, Stop-Outs, margin calls, stop-and-take profit orders, and deposits and withdrawals.

cTrader news

Automated trading is the next significant element when comparing the MT5 and cTrader platforms. Expert Advisors are manually programmed algorithms that traders use in MetaTrader apps (MT4 and MT5) to perform automated duties such as technical analysis of price data. Moreover, these algorithms open and close positions on specific instruments.

The primary difference between MT4 and MT5's Expert Advisors is the programming language each uses. Since MQL4 has been around longer than MQL5, traders who lack programming experience can create custom expert advisors using more pre-written scripts and codes. But because MQL5 is a more straightforward programming language, writing new scripts is also simpler.

Moreover, cTrader has a news and economic calendar feature that ensures you are current with significant market events. This feature is especially beneficial for fundamental traders, who can follow news and trade on the same platform.

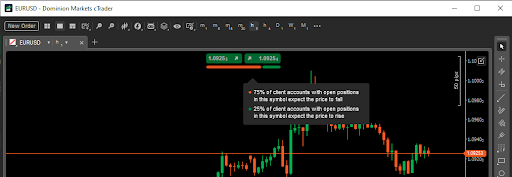

Another unique tool for cTrader is the market sentiment tool. With each chart, cTrader allows you to see the distribution of sellers and buyers from the available open position. This feature shows you which side is stronger and whether most traders are buying or selling a specific asset.

cTrader market sentiment

MT4 alerts

MT4 offers alerts based on the price exceeding or falling below the bid and ask levels. You can also set alerts for significant events. It also provides a signals window where traders can pick a signals provider to copy their trades.

cTrader and MT4 offer several order types. With MT4, traders can use pending orders, market orders, stop orders, and trailing stops. On the other hand, cTrader gives you a more comprehensive selection of order types like limit orders, market orders, stop orders, time of day, market range, good till the day, one cancels the other, trailing stops and market order on open.

A nice feature with the stop orders is the advanced take profit and stop loss. With the advanced take profit order, you can set targets in pips or lot sizes. Additionally, you can place multiple take-profit orders for a single trade, allowing you to protect your profits as the trade moves in your direction.

Meanwhile, the advanced stop-loss order allows you to move the stop loss to a break-even position when the price moves in your favor. It allows you to reduce your risk while trading and take more positions after one moves to break even.

Both MT4 and cTrader offer great automated trading features. However, cTrader is better because it uses a popular programming language and has more advanced trading capabilities.

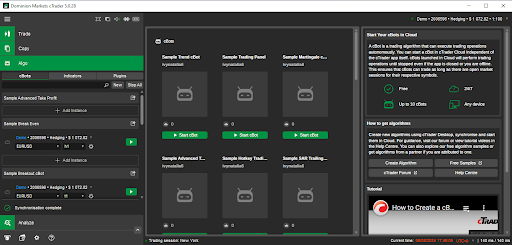

Meanwhile, with cTrader, you use the C# programming language to create cBots and indicators. cTrader allows you to do all this on cTrader Algo. Additionally, traders get access to historical data, visual backtesting, backtesting history and trade statistics.

cTrader Algo

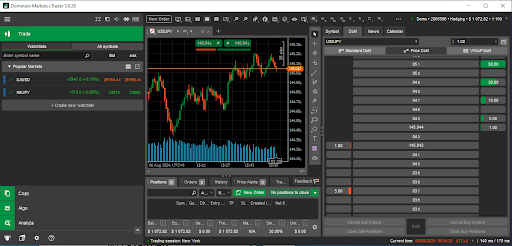

cTrader market depth

Other superior features of cTrader include the Market Depth. Here, you can assess the depth of market in three different ways: price depth, VWAP depth, and standard depth. Therefore, you can look at market liquidity from many more angles than MT4, which only has one.

Furthermore, cTrader offers an impressive backtesting feature that is unavailable on MT4. The Market Replay option allows you to take real trades and backtest your strategy before diving into the real markets. Additionally, it gives you an advanced analysis of your trading results so you can adjust your strategy accordingly.

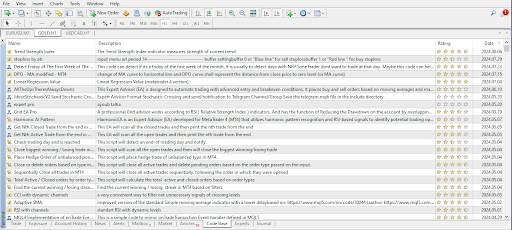

With MT4, traders use the MQL4 programming language to create expert advisors and indicators. Afterwards, you can test these expert advisors on the Strategy Tester and offer them to other traders.

MT4 code base

Both platforms offer algo trading. However, cTrader is considered a better platform as it integrates a popular programming language C#.

MT4 has an old community while cTrader’s community is also growing rapidly and is supported by SpotwareSystems.

cTrader is well known for its fast order execution while MT4 is an outdated platform, though preferred for low resource consumption.

Yes, you can use automated strategies on both platforms. However, cTrader has got an upper hand when it comes to backtesting.

cTrader has more advanced charting tools and other options. It comes with cBots and plenty of custom indicators, scripts and options like detachable charts.

From the above comparison, it is clear that cTrader has the upper hand over MT4 in many areas. cTrader's charting tools are superior, there are more order types that allow you to manage risk better, and it has a more modern design with a user-friendly interface.

TP Market Trades focuses on giving the best to its clients. For this reason, traders get to work with the cTrader platform once they join the family. Join TP Market Trades today and experience the superior features of cTrader.