How to Trade the Morning and Evening Star Candlestick Patterns on TP Market Trades

The Morning and Evening Star candlestick patterns, which consist of three candlesticks each, are valuable tools for traders looking to catch trend reversals as they begin. This article will delve deeper into the meaning of these patterns, how to identify them, and how to trade them on TP Market Trades.

MORNING STAR CANDLESTICK PATTERN

The Morning Star is a bullish reversal pattern that occurs at the bottom of a downtrend. It comprises a large bearish candlestick, a small middle candle, and a third large bullish candle.

The Morning Star pattern shows a strong bearish trend with large candles that suddenly pauses as bears and bulls fight for control. Soon, this period of indecision ends with bulls taking control and reversing the trend.

When you start trading the Morning Star pattern, you will realize that the pattern will not always look the same. Therefore, it is important to know what increases the chances that it will lead to a winning trade. You must focus on some of the key features below.

BULLISH CANDLE SIZE

Comparing the size of the bearish and bullish candles in a Morning Star pattern is important. The bullish candle that shows a new trend should go past the midpoint of the bearish candle. However, the higher above the midpoint it closes, the bigger the chance of a reversal. This is because bulls are showing massive strength.

GAPS

A textbook Morning Star pattern forms with gaps separating the middle candle from the others. However, finding such a pattern in the market is difficult. So, most times, you don't have to see these gaps. Still, when you see the gaps, it is a sign of great indecision.

First, bears show solid strength by gapping down, but bulls also show massive strength by gapping up. Therefore, they are battling for control. This increases the chance that the pattern will lead to a reversal.

CANDLE SIZE

Small-candled Morning Star

When you see a Morning Star pattern where the candles are small, it shows the previous trend was weak, and any reversal after that will be small. The chart above shows such a pattern, which barely led to a reversal. On the other hand, the larger the size of the candles, the more significant the reversal. Big candles show a strong previous trend and a sharp reversal to another strong trend.

DOJI STAR

If the middle candle is a doji without a body, there is a higher chance that the pattern will lead to a reversal. The doji shows that the candle closed near the open, showing greater indecision in the market.

Some traders use the Morning Star pattern with volume for better results. There is a higher chance the pattern will lead to a reversal if the volume on the first (bearish) candle is lower than that of the last (bullish) candle. This is a sign that there is less interest in pushing prices lower. Instead, traders are more interested in pushing prices higher.

Finally, when the pattern comes near a strong support level, there is a higher chance that it will lead to a reversal. This also helps filter out false signals that come during a downtrend.

HOW TO IDENTIFY THE MORNING STAR CANDLESTICK PATTERN

Morning Star candlestick pattern

To identify the morning star pattern,

- Look for a downtrend in the market.

- Wait for a big red, bearish candle to form. This candle confirms the downtrend.

- Wait for a small red or green candle with a small body to form. This candle can also be a doji, which shows a period of indecision and indicates a battle for control between bears and bulls.

- Wait for a big green bullish candle to form. This candle should close above the midpoint of the first candle. It shows that bulls are nearly as strong as bears. Moreover, it confirms a shift in sentiment, which could lead to a reversal.

HANGING MAN CANDLESTICK PATTERN

The hanging man candlestick pattern looks exactly like the hammer. The only difference is where it appears and what it indicates. The hanging man comes at the top of a bullish trend and signals a looming reversal to the downside. Therefore, it is a bearish reversal pattern.

The pattern has a long lower wick with a small red or green body at the top. It shows that bears gained enough momentum to push the price lower. Although bulls return and reverse the sudden dip, they are still not strong enough to close far above the open. This also indicates exhaustion in the bullish move. Therefore, there is a high chance that bears will take control.

However, since this is also a single-candlestick pattern, it is better to wait for confirmation that bears are taking over. Moreover, you can improve the performance of this candlestick pattern by using it with strong resistance levels. A hanging man pattern near a solid resistance barrier has a higher chance of leading to a bearish reversal.

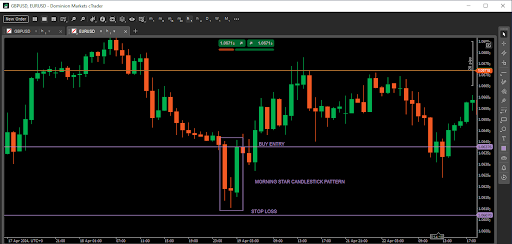

HOW TO TRADE THE MORNING STAR CANDLESTICK PATTERN

Trading the Morning Star candlestick pattern

To trade the Morning Star pattern, after identifying it, wait for the last bullish candle to close and enter a buy position. Here, there is no need to wait for another candle since the third candle in the pattern confirms a reversal.

However, if you are a more cautious trader, you can wait for another bullish candle before entering a buy position. Place your stop loss below the previous low with appropriate targets.

EVENING STAR CANDLESTICK PATTERN

TThe Evening Star is a bearish reversal candle that occurs near the top of a bullish trend. It consists of three candles and is the opposite of the Morning Star candlestick pattern.

The first candle is big and green. This confirms that the current trend is bullish. After that comes a middle candle, which can be green or red and has a small body. This candle indicates a period of indecision after the bullish trend. Finally, the price makes a big red candle that confirms a bearish reversal.

Initially, there is a solid bullish trend that pauses and enters a period of indecision. Here, there is a battle for control between bulls and bears. In the end, the bears win and confirm a trend reversal. Several little things increase the chances that the Evening Star will lead to a reversal. These include.

PRICE GAPS

Gaps between the two large candles and the middle candle increase the chances that the pattern will lead to a reversal. This is because the gaps show bigger indecision, with both bulls and bears showing massive strength.

DOJI STAR

When the middle candle in the Evening Star pattern is a doji, there is a higher chance that the trend will reverse to the downside. A doji is a sign of great indecision in the market right before bears take control.

CANDLE SIZE

Small-candled Evening Star

When an Evening Star pattern forms with small candles like the one above, it is a sign that the previous trend was weak. Therefore, there might only be a short reversal. Meanwhile, an Evening Star pattern with large candles will likely lead to a strong reversal because it shows strong moves before and after.

BEARISH CANDLE SIZE

Moreover, when identifying an Evening Star, you must pay attention to the size of the bearish candle compared to the bullish candle. The more the red candle overlaps the green candle, the higher the chances of a reversal. This is because bears have shown massive strength.

Traders use the Evening Star pattern with volume to increase the chances of winning. There is a higher chance of a bearish reversal if the volume of the bullish candle is lower than that of the bearish candle.

Furthermore, the pattern has a higher chance of leading to a reversal if it comes near a strong resistance zone.

HOW TO IDENTIFY THE EVENING STAR CANDLESTICK PATTERN

Evening Star candlestick pattern

To identify the Evening Star pattern,

- Wait for a bullish trend.

- Wait for the price to make a strong green bullish candle, confirming the prevailing trend.

- Wait for the price to make a small-bodied red or green candle, showing indecision.

- Look for a strong red bearish candle that confirms a reversal. This candle should close below the middle point of the bullish candle.

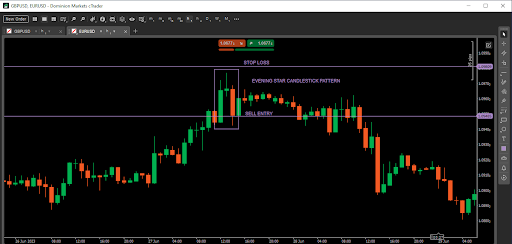

HOW TO TRADE THE EVENING STAR CANDLESTICK PATTERN

Trading the Evening Star candlestick pattern

To trade the Evening Star candlestick pattern, place your sell entry after the last red candle that confirms a bearish reversal. However, more cautious traders wait for another bearish candle before entering a sell position. Place your stops above the previous high with appropriate targets.

Join TP Market Trades today and use the Morning and Evening Star candlestick patterns to catch the best reversals