Differences In Backtesting Between Ctrader And Metatrader 5

Backtesting is using historical data to test a strategy before using it. This test shows you how a strategy might perform in the live markets. Successful traders will always test a strategy before using it in the real market.

Therefore, before starting your journey with TP Market Trades, you must learn how to backtest and the best platform for doing this. This article will look at backtesting on cTrader and MetaTrader 5. It will explore the differences between the two platforms and what each offers. That way, you can choose the best platform to test your strategy before trading.

IMPORTANCE OF BACKTESTING

You should backtest a strategy before using it in the live markets for many reasons.

TEST STRATEGY PERFORMANCE

Backtesting lets you see whether a strategy will make or lose money in the long run. With historical data, you can do this quickly so that when you use the strategy in the live market, you are sure it will return a profit. On the other hand, if the strategy loses, you can dump it for another or try to improve it.

EXPECT DRAWDOWNS AND LOSING STREAKS

Backtesting results allow you to see the kind of drawdowns and losing streaks a particular strategy has. Therefore, you can expect these downturns when you use it in the live markets. This helps prevent strategy hoping every time you meet a losing streak.

IMPROVE THE STRATEGY

Backtesting also allows you to tweak and improve your strategy before using it. If you notice that it is not performing as well as expected, you can add or remove some elements to see whether it gives a better result. The best part is that you can do this without risking your capital. Moreover, you can do it in a short time.

BUILD CONFIDENCE

Finally, backtesting allows you to build confidence in your strategy. It will enable you to go through so many trades in a short time. Additionally, if the strategy performs well in the long run, it gives you the confidence to trade it despite losing streaks or drawdowns. Confidence allows you to use one strategy and to always follow its rules.

HOW TO BACKTEST ON cTRADER

The cTrader platform allows you to backtest using the Market Replay option. This gives you access to historical data that you can use to simulate trades and see the performance of your strategy. To do this, open your cTrader platform and click the Market Replay button.

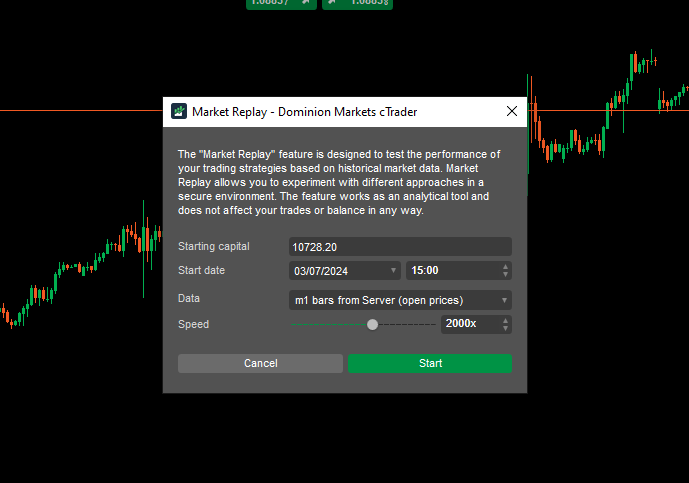

cTrader Market Replay

You can find this button on the lower right side of your chart. Once you click on this option, you will see a new window where you can input parameters for your backtesting, as shown below.

cTrader Backtesting parameters

Here, you can add your starting capital. This is a crucial feature as it will give you an idea of how much you will make or lose with a particular strategy. Therefore, it is essential to use an initial capital amount that is in your trading account.

After that, you can choose when to start your backtesting. The further back you start, the more trades you can take. This will allow you to get enough data to show how the strategy performs in the long run.

Then, you can choose the type of data you want. cTrader gives you the option of using the open prices of one-minute bars from the server or the more accurate tick data from the server.

Finally, you can choose the speed you want the replay to move. This depends on your preference. You can always change the speed after you start the backtest. After setting all the parameters, click the start button to begin the process.

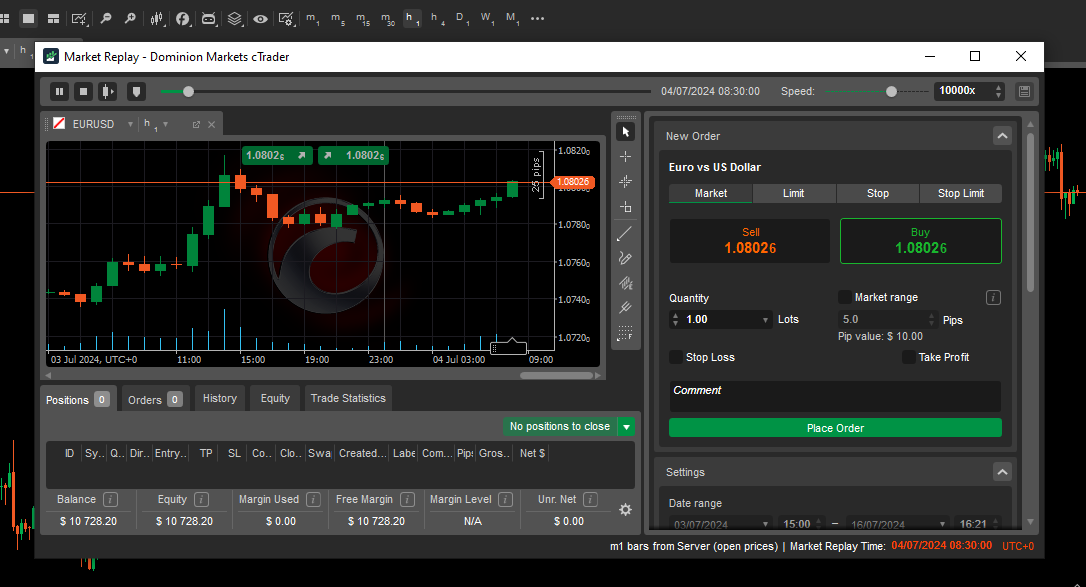

cTrader backtesting window

The start button opens a new window where you can start backtesting your strategy. This window gives you a chart of the asset you are backtesting. Here, you can add the tools you need for your strategy.

Moreover, you can pause to enter a trade and replay it to see whether it leads to a profit or a loss. You can also keep changing the speed depending on whether there are trading opportunities. All trades are then recorded to see the final performance.

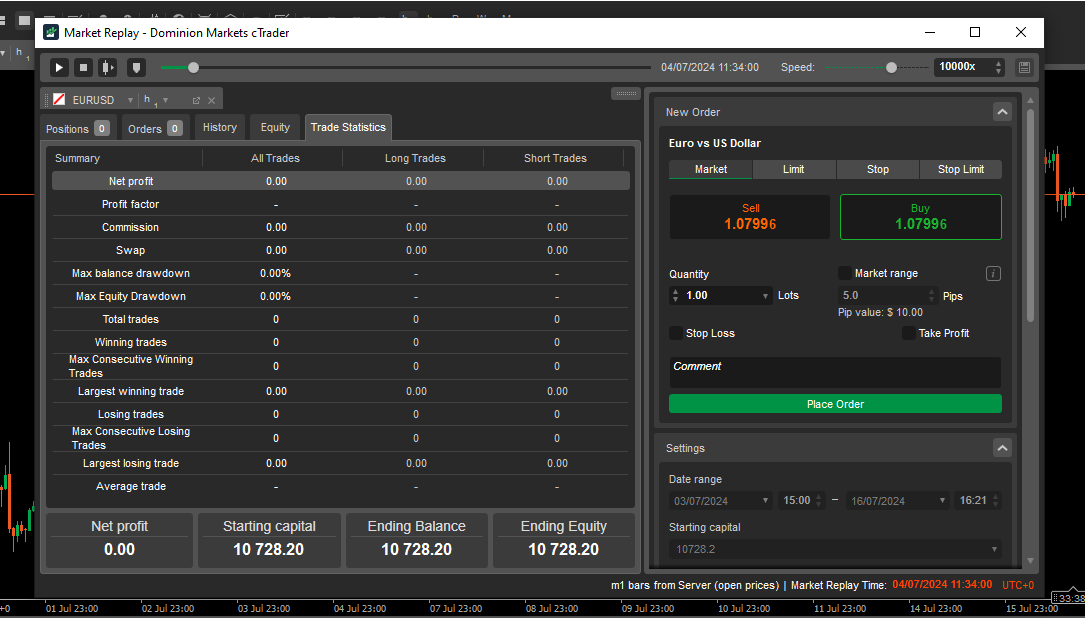

cTrader backtesting statistics

After you have completed your backtesting, you can enlarge the small window on the left corner to see the history, equity curve and trade statistics. The trade statistics give you valuable information about your strategy, including the profit factor, maximum drawdowns, losing and winning streaks, and so much more. From here, you can see whether the strategy is good enough for the live markets. If not, you can tweak it and test it again.

HOW TO BACKTEST ON METRADER 5

Backtesting on MetaTrader 5 is quite different from cTrader. Here, you have to do most of the work yourself because most of it is manual. To start backtesting, open a chart on MT5 and turn off the auto scroll option. This will allow you to go back in history where you can then backtest your strategy.

MT5 backtesting

After clicking on the auto scroll option, you can scroll back as far as you want to start testing your strategy. To move forward, use the F12 key on your keyboard. This key lets you move one candlestick at a time as you take trades.

Record your trades and the results in a separate spreadsheet for analysis after you are done backtesting.

DIFFERENCES BETWEEN cTRADER AND MT5 BACKTESTING

It is clear that cTrader and MT5 are very different when you are backtesting your strategy. cTrader has a more streamlined process for backtesting that gives you all the tools you need, which are not available on MT5.

|

cTrader Backtesting |

MetaTrader 5 Backtesting |

|

The replay makes backtesting much easier since you don’t have to keep pressing a button to move the market. Moreover, you can’t see a candle until it forms. This makes backtesting more realistic because it gives you conditions like those of a live market. The only difference is that you can make the data come in faster. |

Here, you have all the candles on the chart. Therefore, you have to exercise a lot of discipline to ensure you don’t keep checking ahead before placing a trade. |

|

The platform allows you to take a trade like you usually would in a live market. This makes backtesting more like the real thing so that you can get a more accurate picture of how your strategy will perform. |

Here, you take paper trades, which are different from what you would do in live trading. |

|

cTrader records all the trades you take automatically, making work easier. |

When using MT5, you have to manually record all the trades you take, which can be tedious. |

|

cTrader gives you a precise analysis of all the trades taken, giving you insight into your strategy. |

With MT5, you have to do analysis calculations yourself, and sometimes, you might miss essential factors like losing streaks and drawdowns. |

From the above, it is clear that the cTrader platform is superior when it comes to backtesting. It gives a fantastic simulation of live market conditions and a detailed analysis of all trades taken after the test.

Join TP Market Trades today and start testing new strategies on the cTrader platform. Experience the best backtesting conditions and get detailed analytics of your strategy.