How to Trade the Hammer, Hanging Man, and Shooting Star Candlestick Patterns on TP Market Trades

Candlestick patterns in forex can have a single candle or more than one. This article will focus on three single-candlestick patterns you can incorporate into your trading strategy. We will examine how you can trade the hammer, hanging man, and shooting start candlestick patterns on TP Market Trades. You will learn what these patterns mean and how to identify and trade them.

HAMMER CANDLESTICK PATTERN

The hammer is a bullish reversal pattern that occurs in a downtrend. It consists of a small body, a long lower wick, and a very short or absent upper wick. The body can be either red or green. This pattern indicates that the price might soon reverse to the upside.

The psychology behind the hammer is quite simple. The long wick is a sign that bears pushed the price lower. However, they could not close near the lows as bulls emerged to reverse the move to near the open. Therefore, it indicates a sudden surge in bullish momentum that could lead to a shift in sentiment.

However, since this is a single candlestick pattern, experienced traders know to wait for confirmation that sentiment has shifted. Otherwise, it could be a false signal.

Moreover, traders use this pattern with other tools like support levels to improve performance and filter false signals. Therefore, if a hammer appears near a solid support level, there is a higher chance that the price will reverse to the upside.

IDENTIFYING THE HAMMER CANDLESTICK PATTERN

Hammer candlestick pattern

To identify the hammer candlestick pattern,

- Look for a downtrend in the market. Since it is a bullish reversal pattern, it should come after a downtrend.

- Wait for the price to form a large wick that is two or three times the size of the body.

- Wait for the price to form a small body at the top of this lower wick to show the price closed near the open. The pattern can have a small upper wick or none at all.

TRADING THE HAMMER CANDLESTICK PATTERN

Trading the hammer candlestick pattern

To trade the hammer candlestick pattern, after identifying it, it is better to wait for confirmation. Wait for the price to make a solid bullish candle after the hammer to confirm a new direction. Place your buy entry after this candle, with stops below the previous low and appropriate targets.

HANGING MAN CANDLESTICK PATTERN

The hanging man candlestick pattern looks exactly like the hammer. The only difference is where it appears and what it indicates. The hanging man comes at the top of a bullish trend and signals a looming reversal to the downside. Therefore, it is a bearish reversal pattern.

The pattern has a long lower wick with a small red or green body at the top. It shows that bears gained enough momentum to push the price lower. Although bulls return and reverse the sudden dip, they are still not strong enough to close far above the open. This also indicates exhaustion in the bullish move. Therefore, there is a high chance that bears will take control.

However, since this is also a single-candlestick pattern, it is better to wait for confirmation that bears are taking over. Moreover, you can improve the performance of this candlestick pattern by using it with strong resistance levels. A hanging man pattern near a solid resistance barrier has a higher chance of leading to a bearish reversal.

IDENTIFYING THE HANGING MAN CANDLESTICK PATTERN

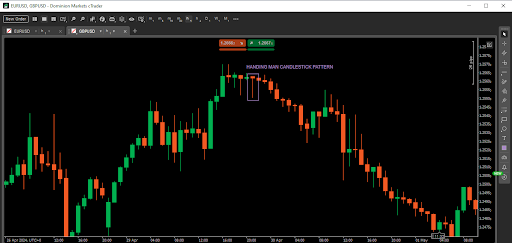

Hanging man candlestick pattern

To identify the hanging man candlestick pattern,

- Look for a bullish trend in the market. Since the pattern indicates a looming bearish reversal, it should come after a bullish run.

- Wait for the price to form a long wick that is two or three times the size of the body. This wick shows a temporary surge in bearish momentum.

- Wait for the price to form a small red or green body at the top of this wick, showing the price closed near its open. The pattern can also have a small upper wick or none at all.

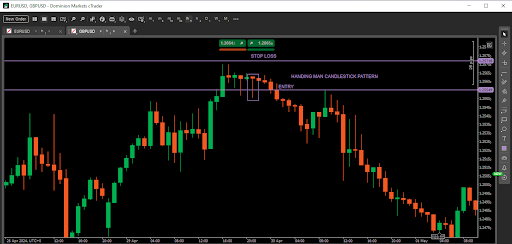

TRADING THE HANGING MAN CANDLESTICK PATTERN

Trading the hanging man candlestick pattern

After identifying the pattern, you can trade it by waiting for confirmation that bears have taken over. Therefore, wait for a solid bearish candle after the hammer. Enter your sell position on the next candle and place your stops above the previous high. Finally, place appropriate take profit targets.

SHOOTING STAR CANDLESTICK PATTERN

The shooting star is a bearish reversal candlestick pattern with a small body, a long upper wick, and a very small or absent lower wick. It comes after a bullish trend and shows that although bulls pushed the price higher, they could not close near the highs.

This means that bears were waiting to push the price lower. Consequently, it indicates a surge in bearish momentum that leads to a close near the open.

Since the shooting star is a single-candlestick pattern, it performs better when you wait for confirmation that bears are reversing the trend. Again, just like the hanging man, when it appears near a strong resistance level, there is a higher chance that it will lead to a bearish reversal.

IDENTIFYING THE SHOOTING STAR CANDLESTICK PATTERN

Shooting star candlestick pattern

To identify the shooting star pattern,

- Wait for a bullish trend in the market.

- Wait for the price to form a large upper wick, showing that the bears reversed the move higher.

- Wait for the price to form a small red or green body, showing the price closed near its open.

- The pattern can have a small lower wick or none at all.

TRADING THE SHOOTING STAR CANDLESTICK PATTERN

Trading the shooting star candlestick pattern

After identifying the shooting star pattern, wait for the price to confirm a reversal with a bearish candle. When this happens, place your sell entry on the next candle with your stops above the previous high. Place targets depending on your strategy.

With this new set of skills, you can incorporate the hammer, hanging man, and shooting star candlestick patterns into your strategy. Moreover, working with TP Market Trades, you can gain access to some of the best trading conditions to apply these patterns. Join TP Market Trades today and trade the most popular candlestick patterns.