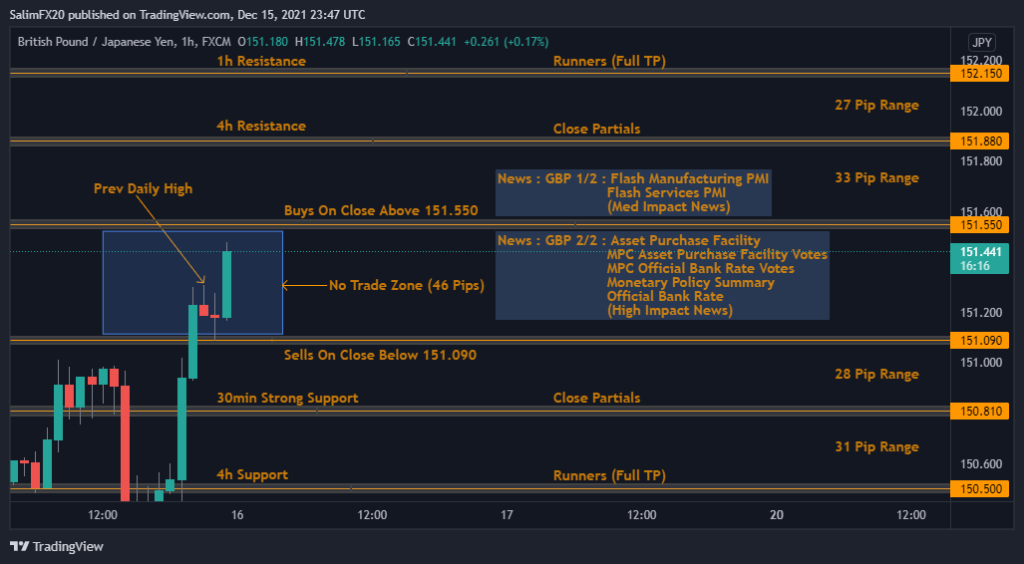

The Consumer Price Index (CPI) rose by 5.1% in the 12months to November, up from 4.2% in October which was the steepest incline for a decade and more than double the Central Bank’s Target (2.0%) As the UK Inflation hits 10-year High, It is important to pay attention to the Bank Of England’s Monetary Policy Meeting today to see if they decide to use their tools to Tighten their Monetary Policy in order to keep Inflation close to Target 2.0% by raising Interest Rates.

EDUCATION:

–

: Official Bank Rate BoE:- Interest Rates at which the Bank of England lends to financial institutions overnight.

: Official Bank Rate BoE:- Interest Rates at which the Bank of England lends to financial institutions overnight.– the Bank of England (BoE) base rate is often called the Interest Rate or Bank Rate, it sets the level of interest all other banks charge borrowers. The Base Rate currently is 0.1%.

– The government sets the Bank Of England an inflation target to keep it in check. The Monetary Policy Committee (MPC) then decides on the Interest Rate.

– Monetary Policy is action that country’s central bank or government can take to influence how much money is in the Economy and how much it costs to borrow. As BoE is the UK’s central bank, they use 2 main Monetary Policy tools.

they set the interest rate that charges banks to borrow money from (BoE), BoE can create money digitally to buy corporate and government bonds and this is known as asset purchase or quantitative easing(QE).

– Monetary policy affects how much prices are rising called the rate of inflation. They set Monetary policy to achieve the Government’s target of keeping inflation at 2%.

– Low and stable inflation is good for the UK’s Economy. They also support the government’s other economic aims for growth and employment.

– The MPC meet roughly every 6 weeks. MPC has 9 Individual members. Before they decide what action to take, they hold several meetings to look at how the Economy is working.- it can take around 2 years for monetary policy to have its full affect on the Economy. So MPC members need to consider what inflation and growth in the Economy are likely to be in the next few years.